Generally you could expect to pay anywhere from 1 to 3-4 of the sale price in fees. How Much Youll Pay in Closing Costs The total closing costs paid in a real estate transaction vary widely depending on the homes purchase price loan type and the lender you use.

Closing Costs For New Jersey Home Buyers 5 Things To Know

Closing Costs For New Jersey Home Buyers 5 Things To Know

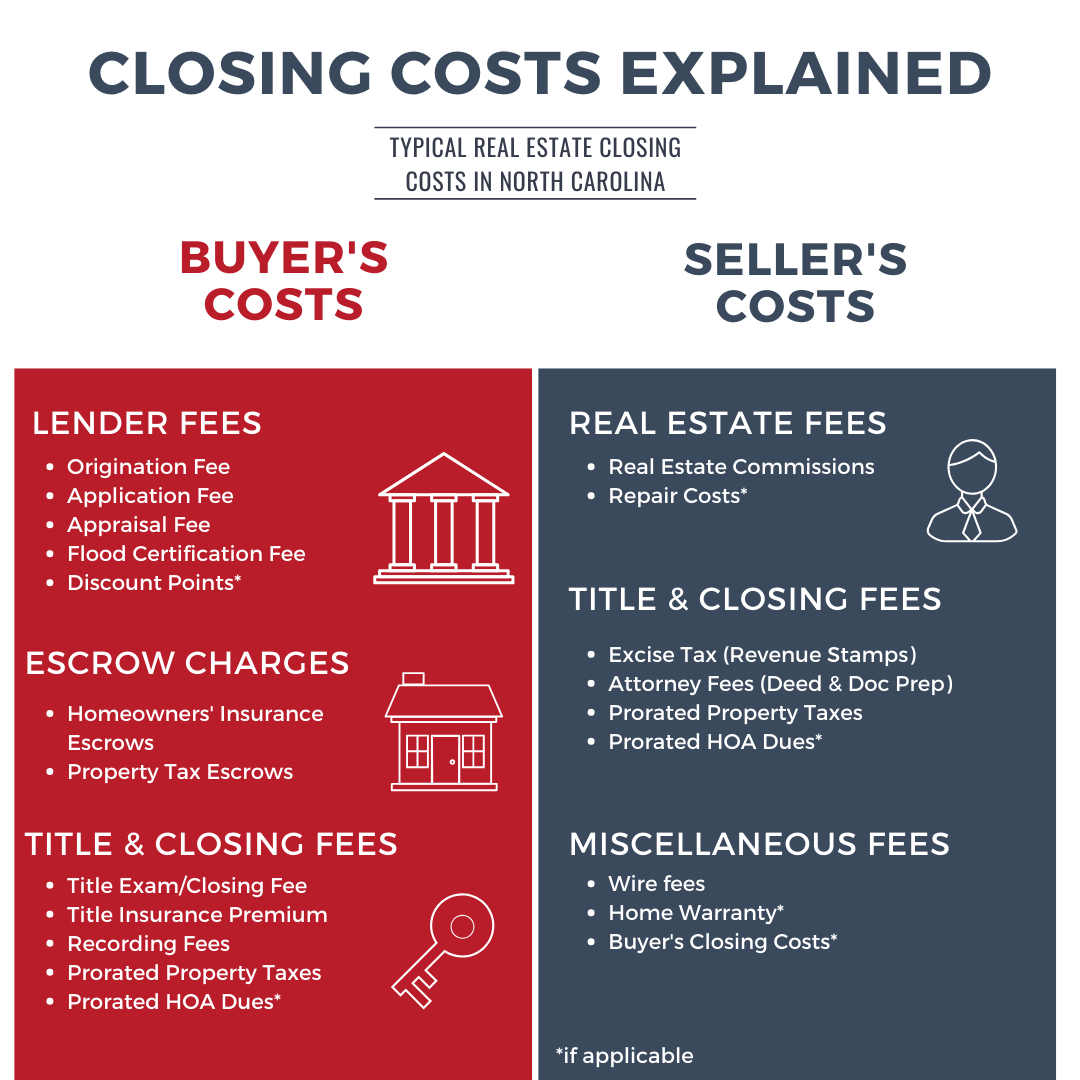

Closing Costs are complex.

How much closing costs for 350k house. How much are closing costs. The average closing costs for a seller total roughly 8 to 10 of the sale price of the home or about 19000-24000 based on the median US. How much will closing on a house cost you.

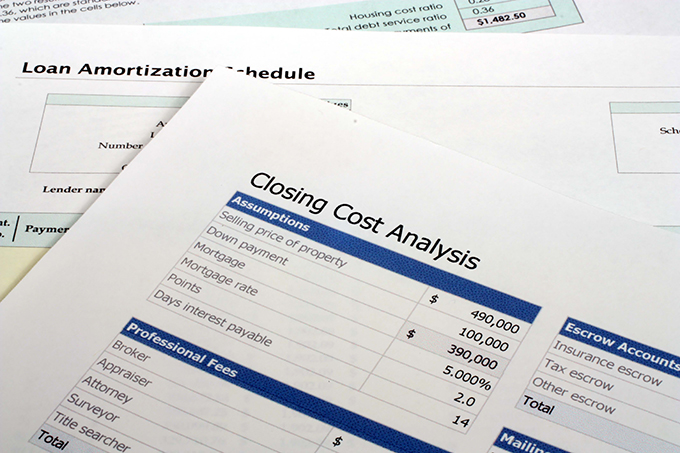

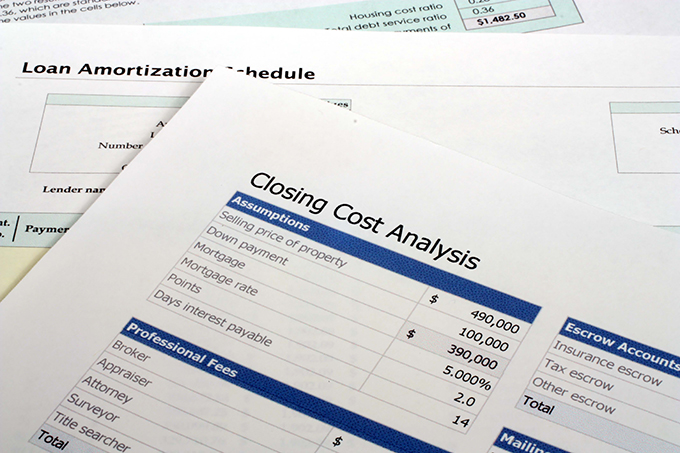

How much are closing costs. How Much is the Down Payment for a 350000 Dollar Home. While each loan situation is different most closing costs typically fall into four categories.

And the figures arent for the faint-hearted. NerdWallets closing costs calculator empowers you with cost estimates based on your financial situation and detail on which costs are shoppable. Over the life of the loan a few small percentage points can result in hundreds of thousands of dollars in interest payments.

For example closing costs on a 100000 mortgage might be 5000 5. So if your home cost 150000 you might pay between 3000 and 7500 in closing costs. The cost varies by location type of survey type of property and geographical and legal complications.

The best guess most financial advisors and websites will give you is that closing costs are typically between 2 and 5 of the home value. The buyer of a home will usually be required to pay for an inspection closing costs and other fees during the closing process. Over the life of the loan a few small.

17 Zeilen Closing Costs on 350000 Home. Overall the general range can be expected to be between 350 and 600. Purchasing a more expensive home than before will usually result in paying more in taxes and insurance.

On average buyers pay roughly 3700 in closing fees according to a recent survey. Seller closing costs are made up of several expenses. The monthly gross income is 6250 but after taxes it.

Closing costs are typically 2-5 of your loan amount with a smaller percentage for larger loans. While your lender is required to provide a Loan Estimate explaining your closing costs within. The first thing we need to figure out is the monthly net income.

The budget below is for a married couple with a 75000 household income. Home value of 244000 as of December 2019. USA Today ran a story this year detailing the average costs of closing on a home in the US.

The answer to your question will vary by state and region. We are going to hypothetically see if you can afford that 350706 median priced home. Closing costs also known as settlement costs are the fees you pay when obtaining your loan.

And as a buyer closing costs typically add up to between 2-5 of the final sales price. An average of over 13000. You can expect to pay between 5468 and 13670 cumulatively on closing costs.

The District of Columbia has. They report an average of 13357 for homes with a median value of 210200 and 4985 for important home preparation projects. True enough but even on a 150000 house that means closing costs could be anywhere between 3000 and 7500 thats a huge range.

What is included in closing costs. While closing costs can be expensive one of the largest mortgage expenses is the interest rate. For a 350000 home a 20 down payment would be 70000.

The average closing costs without taxes come to 3339. As the buyer you can pay the costs in cash or finance them in the loan unless you negotiated for the seller to pay closing costs. The average closing costs in the United States total 5749 including taxes.

The closing costs various from state to state and city to. Closing costs are typically about 3-5 of your loan amount and are usually paid at closing. Typically home closing costs are between 2 and 5 of the home purchase price.

What are closing costs. If youre looking to buy a home in Providence RI the median listing price is 224900 making your closing cost range from 4498 to 11245. While closing costs can be expensive one of the largest mortgage expenses is the interest rate.

Closing Costs Calculator How Much Are Closing Costs Nerdwallet

Closing Costs Calculator How Much Are Closing Costs Nerdwallet

2019 Calculator Estimated Buyer Closing Costs In Maryland

Homebuyer Closing Costs For A Residential Real Estate In Colorado 2021

Homebuyer Closing Costs For A Residential Real Estate In Colorado 2021

Va Fha Conventional Mortgage Closing Cost Calculator

Va Fha Conventional Mortgage Closing Cost Calculator

Closing Costs What They Are And How Much You Ll Pay Bankrate

Closing Costs What They Are And How Much You Ll Pay Bankrate

Closing Costs For Sellers Common Fees Associated With Selling Your Home Perfect Agent

Closing Costs For Sellers Common Fees Associated With Selling Your Home Perfect Agent

Va Fha Conventional Mortgage Closing Cost Calculator

Va Fha Conventional Mortgage Closing Cost Calculator

What Are Closing Costs And How Much Will I Pay

Closing Costs In California Explained

Closing Costs In California Explained

How To Calculate Closing Costs On A Home Real Estate

How To Calculate Closing Costs On A Home Real Estate

Home Buyers Closing Cost Calculator Mls Mortgage

Home Buyers Closing Cost Calculator Mls Mortgage

Average Closing Costs In 2021 And How To Keep Yours Low Mortgage Rates Mortgage News And Strategy The Mortgage Reports

Average Closing Costs In 2021 And How To Keep Yours Low Mortgage Rates Mortgage News And Strategy The Mortgage Reports

Delaware Buyer Closing Costs In 2021 How Much Will You Pay

Delaware Buyer Closing Costs In 2021 How Much Will You Pay

Home Mortgage How Much Are Closing Costs Home Mortgage Center

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.