Billed at least one service in an inpatient hospital or emergency room. Quality Payment Program - Merit-based Incentive Payment System MIPS Deadline extended from March 31 2020 to April 30 2020.

Mips Eligibility For 2017 Transition Year Are You Exempt From Mips In 2017

Mips Eligibility For 2017 Transition Year Are You Exempt From Mips In 2017

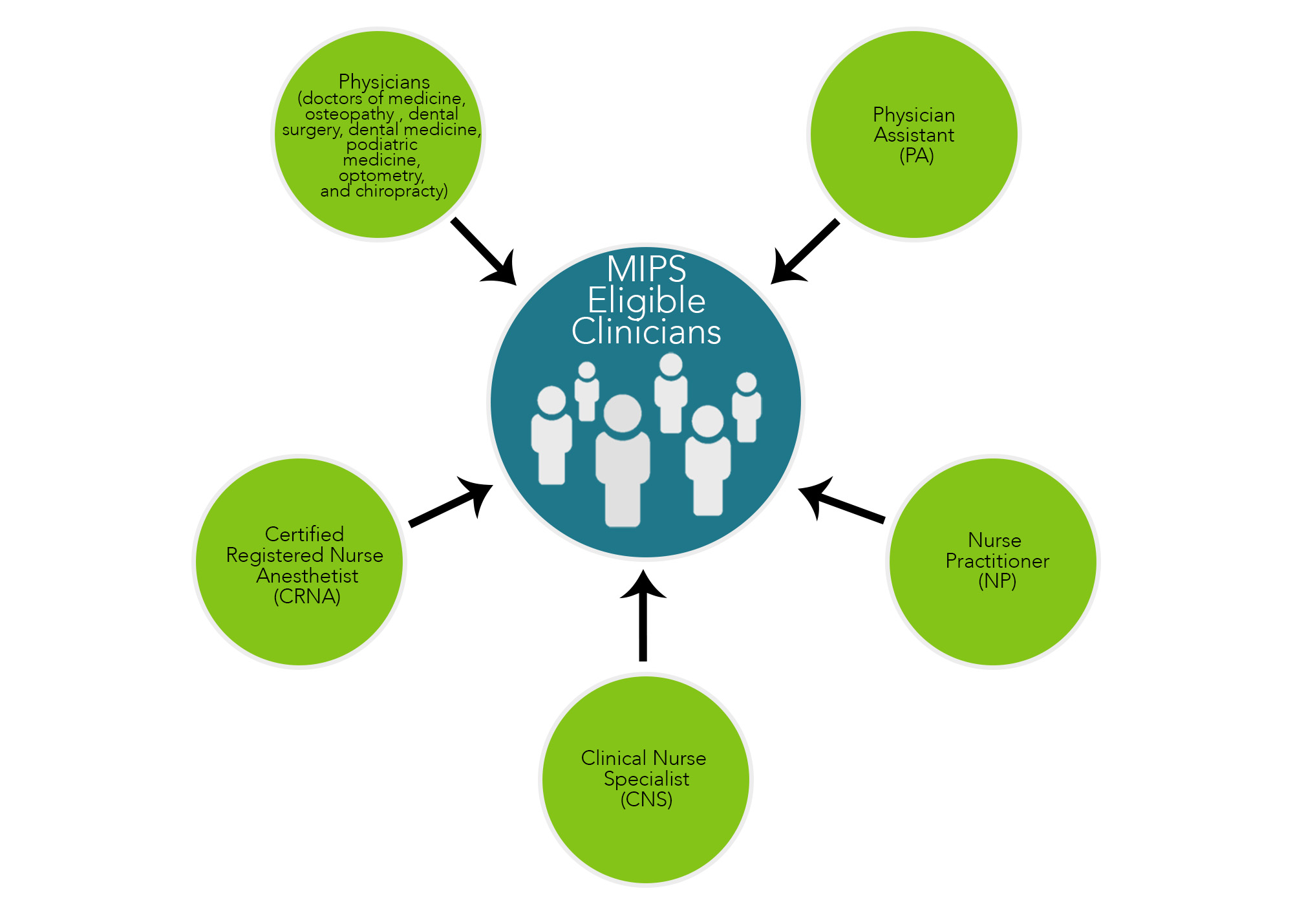

If youre not one of these clinician types youre excluded from reporting.

Mips hospital based providers. MIPS eligible clinicians are considered facility-based using the following criteria. However the QPPs payment implications will vary depending on a number of scenarios such as whether a clinician is attributed to the Merit-Based Incentive Payment System MIPS i. Based on these conditions providers in facility-based outpatient therapy and skilled nursing facility SNF settings are excluded from MIPS eligibility because claims for these settings typically only contain a.

They do not exceed one or more of the low volume thresholds which are. At least 1 clinician must be individually eligible for MIPS. For 2020 MIPS Eligible Clinicians include.

CMS estimated that the MIPS program offered 810000000 in incentives to providers. Certified Registered Nurse Anesthetist CRNA Clinical Nurse Specialist CNS Nurse Practitioner NP. No more administrative work necessary to collect clean and report on data for quality measures in the MIPS.

This 25 percent is re-allocated to the Quality performance category making that category 75 percent for hospital-based providers. Eligible providers would receive the MIPS score in those categories associated with the same percentile as their hospitals score in HVBP. Hospital-based providers for example most Emergency Medicine Hospital Medicine Anesthesia Radiology Providers are exempt from the Advancing Care Information performance category.

Providers and groups must also exceed the three low-volume threshold criteria during both determination periods in order to be eligible for MIPS participation. But as the FAQ warns While this may be beneficial today its likely that hospitals and other physician employers using such models will seek to modify the arrangements over time as the financial implications of MACRA MIPS. Billed at least 75 percent of your covered professional services in a hospital setting.

Providers can choose to participate in MIPS as either. Physicians including doctors of medicine osteopathy dental surgery dental medicine podiatric medicine and optometry. The performance of a MIPS eligible clinician would be individually applicable if that clinician furnishes 75 or more of their covered professional services in an inpatient hospital identified by POS code 21 an on-campus outpatient hospital POS 22 or an emergency room POS 23 based on claims for a period prior to the performance period.

Relative value unit-based compensation plans traditionally have not been tied to overall revenue a hospital collects for those services. OR A group is defined as at least 2 clinicians identified by their individual NPIs sharing a common TIN. MIPS eligible clinicians who have not submitted any MIPS data by April 30 2020 will qualify for the automatic extreme and uncontrollable circumstances policy and will receive a neutral payment adjustment for the 2021 MIPS.

Or to an advanced APM. MIPS eligibility is based on a clinicians National Provider Identifier NPI and the associated Taxpayer Identification Numbers TINs referred to as the TINNPI combination. The clinician must have at least a single service billed with the POS code used for the inpatient hospital.

MIPS is the default program for all providers who bill Medicare Part B. If you are eligible the CMS will automatically calculate a Quality and Cost score and combine this with your score from. Just what that affect might be will vary by a physicians employment and compensation structure.

MIPS is the default program for all providers who bill Medicare Part B. To a MIPS alternative payment model APM. Can be attributed to a facility with a Hospital Value-based Purchasing VBP score.

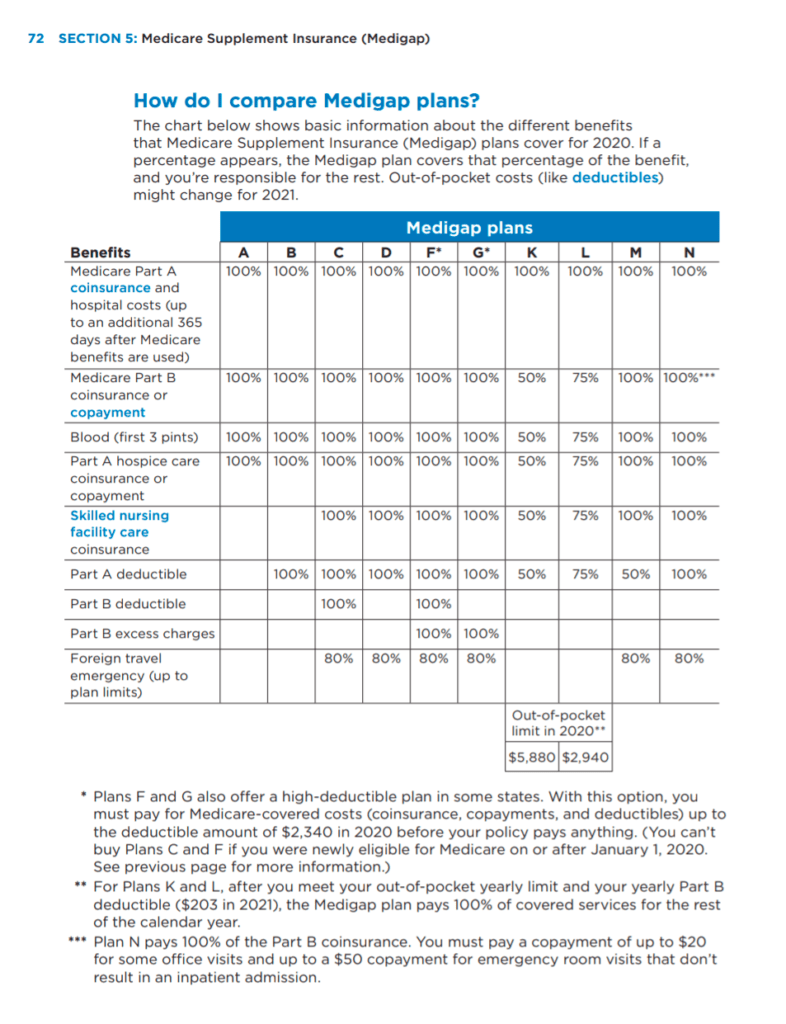

You are eligible to report for MIPS if you are a MIPS eligible clinician type and also meet all the other requirements in the next section. An Individual defined as a single National Provider Identifier NPI tied to a single Tax Identification Number TIN. These include physicians physician assistants nurse practitioners certified nurse specialists and certified registered nurse anesthetists.

For MIPS clinicians are considered hospital-based if at least 75 of covered professional services were provided in POS 21 IP Hospital 22 on-campus OP hospital or 23 ER-hospital for the period of September 1 two years prior through August 31 one year prior to the reporting period. These include physicians These include physicians physician assistants nurse practitioners certified nurse specialists and certified registered nurse. While MIPS-eligible clinicians have a choice of flexible reporting options in 2017 termed Pick Your Pace see MIPS.

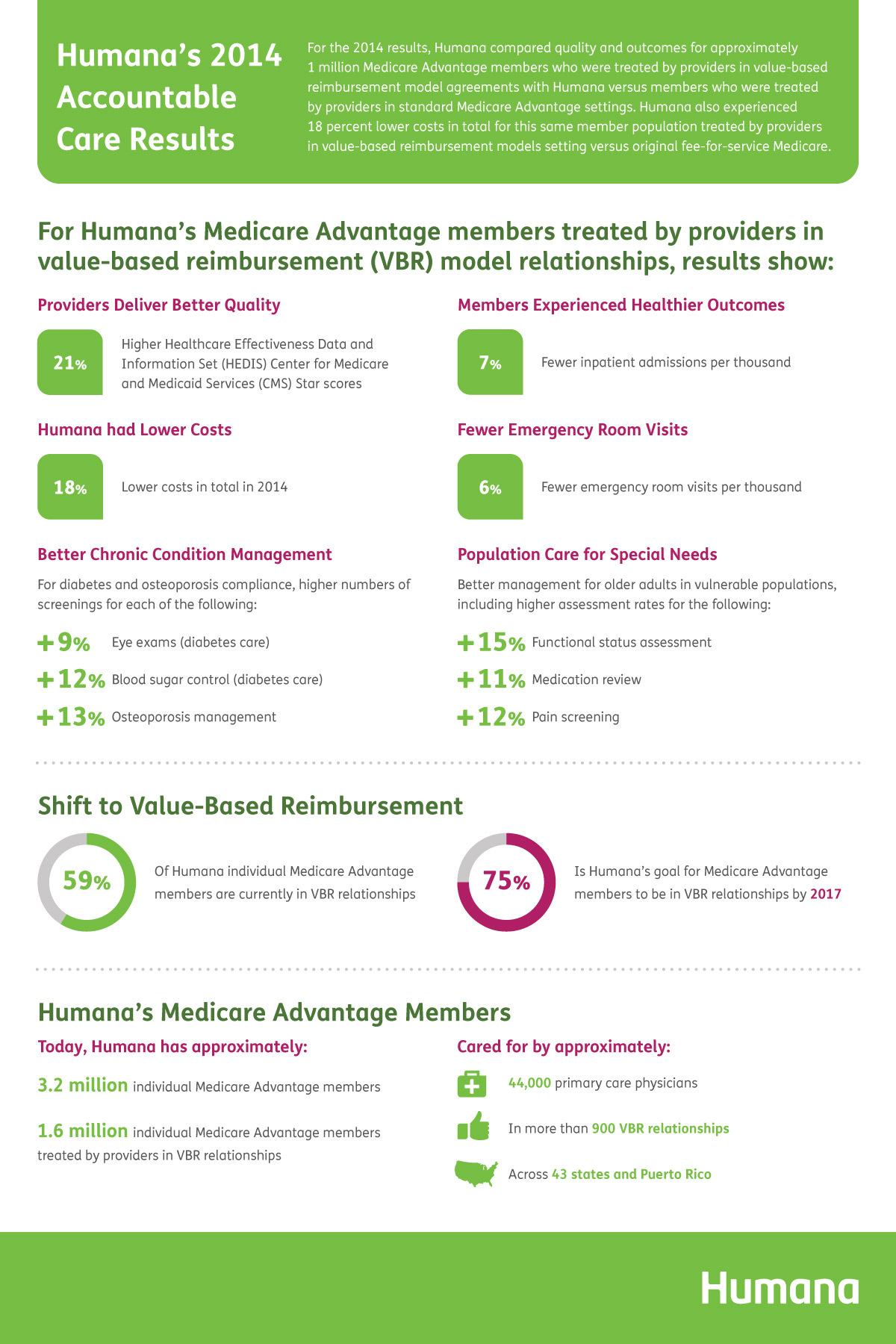

In 2019 hospital providers have a new option for Merit-based Incentive Payment System MIPS in the Quality and Cost categories called facility-based scoring Facility-based scoring provides clinicians with scores in the MIPS Quality and Cost categories using quality measures from the hospital value-based purchasing HVBP program. Conversely Able Health estimates that the MSSP program offered 419587060 to providers after ACOs and hospitals take their cut of the total earned shared savings which CMS reported as 1134019082. Providers may be exempt from the MIPS if.

:max_bytes(150000):strip_icc()/Mutual_of_Omaha-854e01d49f3e43a6ba1e5567bf207b9d.jpg)