AARP Medicare Supplement Plan Overview. In comparing Medigap plans AARP United Healthcare is listed as a community based plan so not affected by a.

Medicare Plan E Availability Comparisons And Costs

Medicare Plan E Availability Comparisons And Costs

The plan pays the Part A Deductible of.

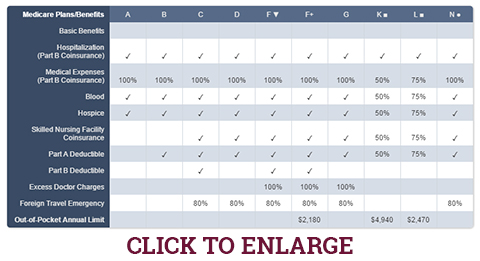

Aarp medicare supplement plan e. Medicare Advantage or Medicare Part C is a privately run alternative to original Medicare. If a check mark appears in the column this means that the MediGap policy covers that benefit up to 100 of the Medicare-approved amount. Medigap Plan E Medicare Supplement Beginning June 1 2010 Plan E will no longer be offered as a Medicare Supplement plan.

In 2021 the standard yearly price of AARP membership is 16 for your first year. Foreign Travel Emergency benefits are included in this plan. AARP Medicare Supplement Plans insured by UnitedHealthcar e Insurance Co.

GRP 79171 GPS-1 G-36000-4. AARP Medicare Supplement Insurance Plans AARP endorses the AARP Medicare Supplement Insurance Plans insured by UnitedHealthcare Insurance Company. AARP endorses the AARP Medicare Supplement Insurance Plans insured by UnitedHealthcare Insurance Company.

Medicare Supplement Plan E is a former Medicare supplement insurance Medigap plan that has not been available to new enrollees since 2010. Current policyholders should note that current Plan E enrollees will not lose their current Plan E coverage. The descriptions of benefits of each of these plans are in the table below.

These fees are used for the general purposes of AARP. Medicare supplement plans already have national GI guaranteed issue guidelines. Overview of Medicare Supplement Plan E Medicare Supplement Plan E is one of the four Medicare Supplement Plans that was eliminated on June 1st 2010 due to the Medicare Modernization Act.

Plan E pays the 20 remainder of Medicare Approved Amounts. Additionally some states have birthday or anniversary rules that allow policyholders to change plans under certain conditions and not be subject to underwriting. About Press Copyright Contact us Creators Advertise Developers Terms Privacy Policy Safety How YouTube works Test new features Press Copyright Contact us Creators.

Insured by UnitedHealthcare Insurance Company Horsham PA UnitedHealthcare Insurance Company of New York Islandia NY for New York residents. Medigap Plan E also known as Medicare Supplement Plan E is an original Medicare add-on that helps cover your Medicare costs. Insured by UnitedHealthcare Insurance Company Horsham PA UnitedHealthcare Insurance Company of New York Islandia NY for New York residents.

Medicare Supplement Insurance also called Medigap is a type of private insurance that is used alongside your Original Medicare coverage Medicare Part A and Part B to help cover certain Medicare out-of-pocket expenses such as copays and deductibles. AARP Medicare Supplement Requirements There are three primary requirements you must meet in order to apply for an AARP Medicare Supplement Insurance plan offered by UnitedHealthcare in 2021. Medigap Plan E was discontinued for new enrollees in 2010.

Note that specific coverage co-insurance co-payments and deductibles may vary by state. Medicare has several gaps and doesnt pay for all of the health care services you may need. The words Medicare supplement and MediGap plans are interchangeable and mean exactly the same thing.

UnitedHealthcare Insurance Company pays royalty fees to AARP for the use of its intellectual property. Watch learn and save. This is health insurance that helps pay for some of.

AARP and its affiliates are not insurers. Medicare Supplement Plan E is one of the few Supplement Plans that has offered enrollees Preventive Care Coverage. GRP 79171 GPS-1 G-36000-4.

Hidden Cost in AARP Medicare Supplement Plan. Here is a brief overview of the AARP Medical Supplement Plans offered by UnitedHealthcare which is part of UnitedHealth Group Inc. Medicare Advantage plans are sold by Medicare-approved private insurance companies and must cover the same health care services as original Medicare except hospice care.

Medicare Plan E was no longer offered to new Medicare beneficiaries as. Phishing is a tactic used by cybercriminals to trick people into sharing personal information online. You must be an AARP member to enroll in an AARP Medicare Supplement Plan.

The Basic Benefits the Part A deductible of 110000 is paid by the plan and Skilled Nursing Coinsurance is included in this plan. The Centers for Medicare and Medicaid Services CMS constantly monitors Medicare Supplement Plans current economic situations and maintains the needs of senior citizens. Likewise Medicare supplement plans are secondary payers and were left out of the legislation.

I got fooled because there is something thats borderline fraudulent regarding the AARP United Healthcare plan premium annual increases being community price rated versus age attained price. You must be an AARP member and continue to pay your AARP dues. If you are in the Original Medicare Plan you may want to buy Medicare supplemental insurance also called Medigap insurance.

How to read the chart. Scammers send a message that acts as bait hoping to. However if a person already has Plan.