The term multi-state health insurance might lead you to believe that you would be covered out of state for your medical insurance but some multi-state plans restrict the coverage areas or may not cover you out of state. The Portuguese health insurance system can be complicated but it has improved considerably in recent years.

Medicare For All What Is It And How Will It Work

Medicare For All What Is It And How Will It Work

Every year the Pennsylvania Insurance Department reviews all proposed health insurance rates and changes to existing rates for plans in the individual and small group markets.

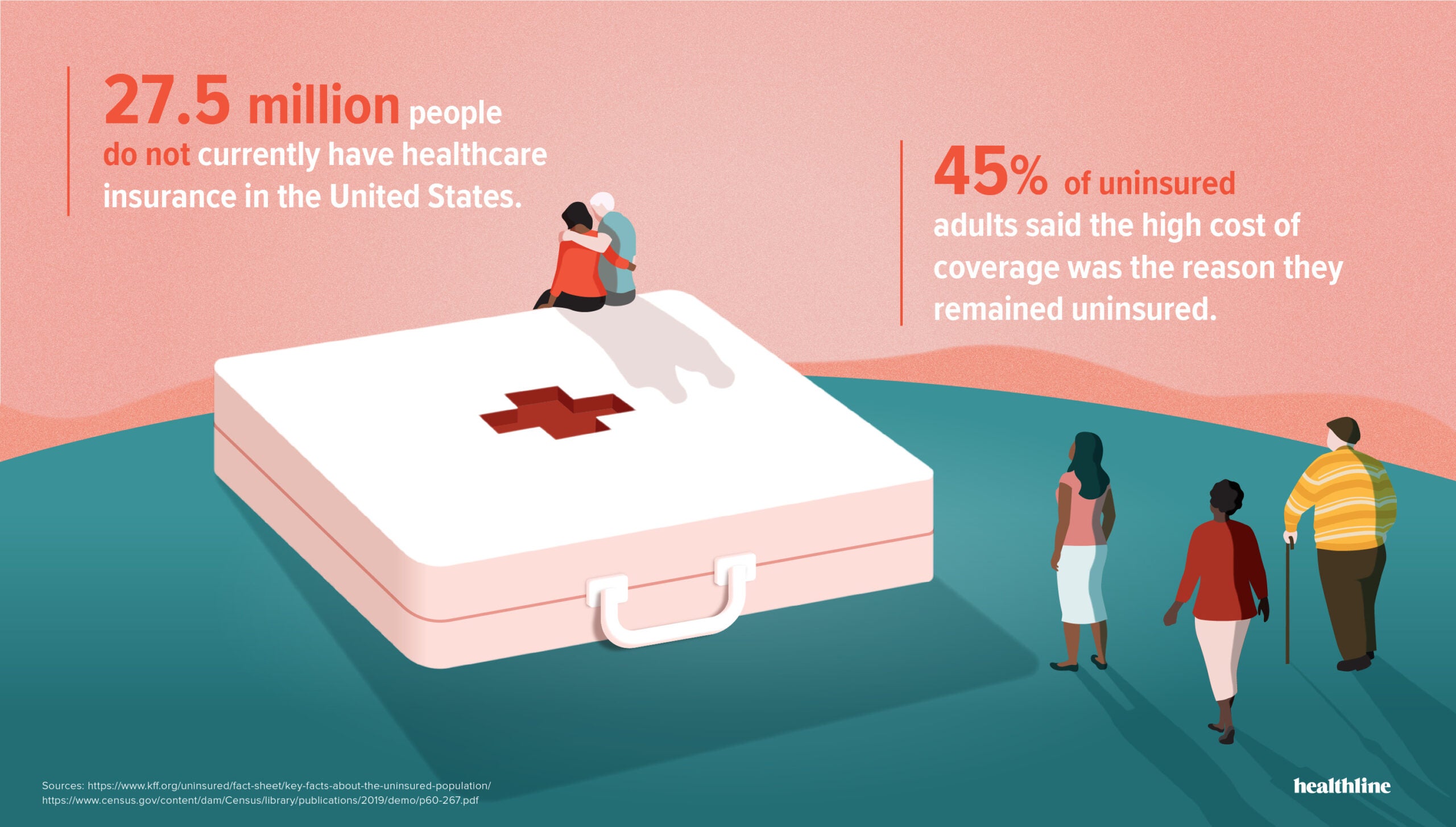

Health insurance that works in every state. In 2017 healthcare cost as little as 4700 in Hawaii or 5500 in Michigan for example. Health insurance offers a way to reduce such costs to more reasonable amounts. Kaiser Family Foundation 16.

Although most states are still following the same model they used in 2014 there have been a few changes in the ensuing three years. According to spokespersons for the state exchange Covered California restoration of the individual mandate helped reduce premiums on average 32 in 2020. We have a number of resources available to help consumers understand this process and obtain information about requested and approved changes to their rates.

An HRA is a health benefit that allows employers of all sizes to offer a set amount of pre-tax dollars to their employees who can then spend it on things like insurance premiums copays and other qualified out-of-pocket costs depending on the HRA. The way it typically works is that the consumer you pays an up front premium to a health insurance company and that payment allows you to share risk with lots of other people enrollees who are making similar payments. The healthcare system and health insurance in Portugal.

Covered California anticipates that this could save Californians an average of 167 per year on their health. When it comes to your health care options on the Marketplace some things are the same in every state. Only some MSP plans offer coverage nationally or across different states.

Office of Personnel Management which administers the health insurance plan for federal government employees. With state and local governments employing over 74 million full-time workers throughout the US public employee benefits like health insurance coverage are of great importance to the state policymakers All 50 states provide health insurance coverage for their state employees however the extent of coverage who is eligible to enroll and employer versus employee premium contributions. Multi-state health insurance plans are available through some of the state-based and federally facilitated health insurance exchanges and approved by the US.

Employee Health Insurance covers workers disease injury and death for both work relationships and non-work relationships. The combination of a high monthly premium high deductible and high copays make Alabama the third-worst state for health insurance costs. Alaska New York and West Virginia are the states with the highest average employer contribution towards total health insurance premiums.

Who wouldnt want nice. Whats the Same in Every State. Their respective averages in 2018 were 17663 17861 and 17919 according to health insurance data by state.

If you live and work in Portugal and contribute to Portugals social security system you will typically be entitled to Portuguese healthcare. It may or may not. However there are things you can do to make sure you keep your coverage or pick up new coverage to avoid gaps.

Offer competitive health benefits to your employees across state lines using a health reimbursement arrangement HRA How does an HRA work. For 2014 16 states and Washington DC. Meanwhile costs were much higher in other states and several topped 8000.

Does your current insurance cross state lines with you. The coverage of Employee Health Insurance is a maximum of 180 days per year of medical care for a work-related disease or injury and 180 days per year for non-work-related disease and injury. Multi-State Plans or MSP options are available through the health insurance marketplace through private insurers.

The snowbird lifestyle is popular with retirees and its easy to see why. In 2018 in Alaska the average employer contribution was 16967. The states lowest-cost silver plan the Silver Compass 5000 plan offered by UnitedHealthcare has a high deductible of 5000 after which the enrollee is still responsible for 20 percent of care costs and a 20 copay for primary doctor visits.

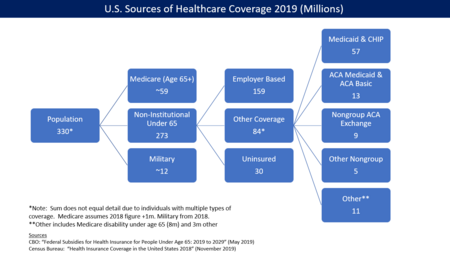

Individual health insurance is coverage that you buy on your own either through the health. When it comes to the ACA marketplaces almost half the states have opted to have at least some control over their own exchanges establishing either a state-based exchange a federally-supported state-based exchange or a partnership exchange but more than half the states have chosen to have HHS run all aspects of their exchanges New Mexico Maine and Virginia all currently use HealthCaregov but are in varying stages of transitioning to fully state. How Health Insurance Works When You Live in Multiple States Individual Health Insurance.

Opted for state-run health insurance exchanges seven states established state-federal partnerships and 27 states opted for the federal exchange.