So did health insurance premiums increase for 2021. Lastly if your monthly Part B premium for 2016 is an amount different from 10490 you must submit the Medicare Part B Annual Premium Reimbursement Request Form as.

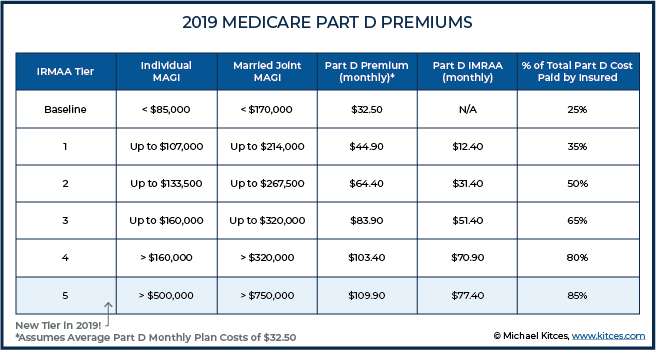

Medicare premiums are based on your modified adjusted gross income or MAGI.

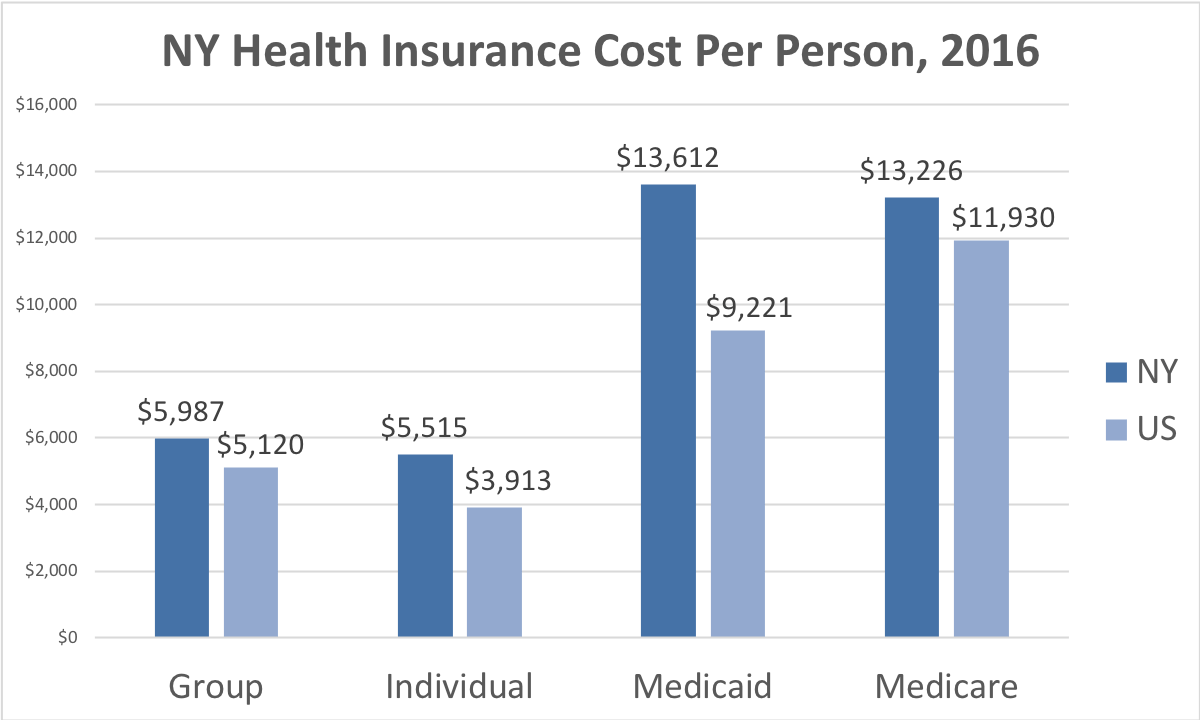

Medicare health insurance premiums. Health insurance premiums and plans found in the above report were aggregated from Public Use Files PUF on the Centers for Medicare Medicaid Services government website. Some beneficiaries with higher incomes will pay a higher monthly Part B premium. Whether you are young or old you need medical insurance to protect you against rising health care costs.

That 400 monthly fee is your health insurance premium. Zero-dollar Medicare Advantage premiums are available to many. MIPP is for some groups who are either not eligible for -- or who are not yet enrolled in-- the Medicare Savings Program MSP which is the main program that pays the Medicare Part B premium for low-income people.

Using the rates and premiums for each plan averages were calculated for a variety of variables such as metal tier family size or county. Health insurance premiums provide tax benefits under Section 80D of the Income Tax Act 1961. In most cases your premium is due the same month that you get the bill.

The type of Medicare Premium Bill Form CMS-500 you get shows if youre at risk of losing your Medicare coverage for late payments. Additionally the average individual deductible was 4364 and the family deductible averaged 8439. Medicare Part C plans often boast no or low monthly premiums.

If you paid Medicare taxes for less than 30 quarters the standard Part A premium is 471. And if you do get a subsidy there are several variables that go into how much your rates might have changed. Monthly Medicare premiums for 2021 The standard Part B premium for 2021 is 14850.

To set your Medicare cost for 2021 Social Security likely relied on the tax return you filed in 2020 that details your 2019 earnings. However some Medicare Advantage options can range from 186-249 monthly The cost will depend on factors such as your benefit choices location and the private insurance company selling the plan. It depends on where you live what plan you have whether you changed plans during open enrollment and whether you get a premium subsidy.

Part A hospital inpatient deductible and coinsurance. If you paid Medicare taxes for 30-39 quarters the standard Part A premium is 259. If your income is different from what the Social Security used to determine.

Healthcare costs are on the rise making it crucial to buy health insurance for you and your family. Thats your total adjusted gross income plus tax-exempt interest as gleaned from the most recent tax data Social Security has from the IRS. If youre single and filed an individual tax return or married and filed a joint tax return the following chart applies to you.

Most people age 65 or older are eligible for free Medical hospital insurance Part A if they have worked and paid Medicare taxes long enough. In 2020 health insurance premiums for unsubsidized individual customers were 456 per month on average while family premiums averaged 1152 per month. If you itemize your deductions instead of taking the standard deduction then the premiums you pay will generally count towards the medical expense deduction.

You can enroll in Medicare medical insurance Part B by paying a monthly premium. While the standard monthly premium for Medicare Part B is 14460 this year some beneficiaries pay as much as 49160. Assurance-maladie is an unofficial designation used to refer to the publicly funded single-payer health care system of CanadaCanadas health care system consists of 13 provincial and territorial health insurance plans that provide universal health care coverage to Canadian citizens permanent residents and certain temporary residents.

All Medicare bills are due on the 25th of the month. 1484 deductible for each benefit period. For example Medicare runs the bill for April on March 27th.

In order for all of your healthcare benefits to remain active the health insurance premium must be paid in full every month. If you are below the age of 60 years you can get an exemption of up to Rs. If your medical premiums are deducted through a payroll deduction plan its more than likely that youre covering your share of your insurance premium with pre-tax dollars.

The Part B premium is 14850 in 2021. The government encourages everyone to invest in health insurance and allows you to claim tax benefits on health insurance premiums. If you are paying your premium on your own your monthly bill will come directly to you.

You cant deduct premiums from your taxes if theyre paid by your employer. 25000 per year and if your age is above 60 years then the benefit increases up to Rs. Health insurance premiums that you pay are a deductible medical expense.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.