However if the employees are going to perform work in Sweden the Foreign Employer is normally obligated to pay taxes in Sweden as well as to register as an employer in Sweden. View and update your W-4.

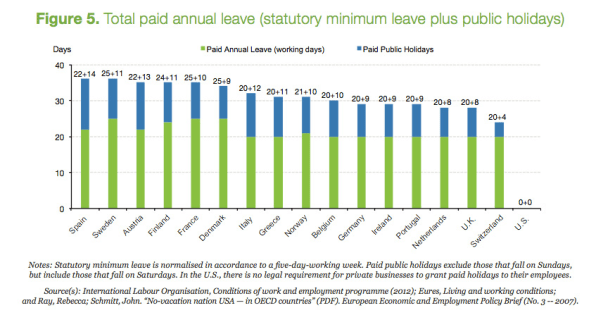

How U S Employee Benefits Compare To Europe S

How U S Employee Benefits Compare To Europe S

Meal cards for residents while on night call service.

Swedish employee benefits. 1021 of this represents pension contributions. Unemployment benefits in Sweden are payments made by the state or other authorized bodies to unemployed people. These contributions amount to 3142 of the gross salary.

You are required to report salaries employee benefits deducted tax and employer contributions in this form. Academic allowance of 300 R1 600 R2 and 900 R3 per resident per academic year for education to be used for seminar travel or textbooks. There is no overall legislation regarding employee benefits but there are some statutory provisions.

Learn about Swedish including insurance benefits retirement benefits and vacation policy. Expatriation premiums for working in Sweden the benefit of free accommodation in employer-owned premises would be valued at market value In the case of employer-rented accommodation the value of the benefit would probably be equal to. 10 days of vacation per year excluding holidays and weekends.

We consider it a privilege to work with employee benefits - insurance that provides security for both businesses and individuals. After 14 days employers report to Swedish Social Insurance Office and the employee applies for the benefits. Except for insurances included in the mandatory employer social security contribution there.

Employee Benefits in Sweden Social Security. - It covers an exhaustive list of employee benefits including retirement benefits death in service long-term disability benefits medical benefits workmens compensation insurance maternity and paternity benefits family benefits unemployment leave and private benefits. Employee Benefits in Sweden.

Only the contributions on income up to a maximum of 807 income related base amounts SEK375255 519 708 kr for 2019 are. The global outlook also means that its normally okay to speak English knowing Swedish is a great benefit though. When you submit the form you also pay the tax and contributions into your companys tax account at the Tax Agency.

It is more common to have fringe benefits in Sweden than in Denmark - also in the public sector. An employer is responsible for paying 80 of an employees salary for the first 14 days of sick leave. It can for example subsidies for fitness and health-related activities eg.

Social insurance pays for sick leave starts on day fifteen. View your paycheck statement see above for links Search and apply for jobs view and update your contact information. Maintain your direct deposit information.

Glassdoor is your resource for information about Swedish benefits and perks. The prospective employer in Sweden must issue an offer of employment with a salary and other terms of employment that are at least equivalent to those of the relevant Swedish collective bargaining agreement or such terms that are customary in the relevant occupation or industry. Consensus for the win.

They can be divided into a voluntary scheme with income-related compensation up to a certain level or a comprehensive scheme that provides a. For you and your employees. As set forth in the Swedish Annual Leave Act employees are entitled to annual leave benefits like vacation leave and pay and compensation in lieu of annual leave.

Employee Self-Service ESS provides employees access to Human Resources and Payroll services. This means that among other things the employer is required to supply an occupational pension and a number of other standard employee benefits. All employers in Sweden pay the social security contributions consisting of charges for pensions health insurance and other social benefits.

Under Swedish law there is no mandatory severance payment this would be set out in the employment contract if applicable. According to Swedish employment law the employer is to decide where work shall be performed ie there is no legal entitlement for the employees to work from home. Every month the Swedish Tax Agency sends out a PAYE form to registered employers.

Benefits information above is provided anonymously by current and former Swedish employees and may include a summary provided by the employer. Our various insurance solutions supplements your business insurance and gives you and your employees even better insurance coverage. Permanent establishment in Sweden to hire employees.

And successful startups such as gaming developer King and financial technology or fintech service Klarna show the way for others. Monthly fitness centre subscription. It is possible to enter into an agreement with.

The employer will also need to pay social security contributions on the locally hired employees salary. 1 white coat per year. If offers accident health.

As an employee you can. However in order to reduce the spread of COVID-19 Swedish authorities have recommended employees to work from home where this is possible.

Government And Defence Average Salaries In Sweden 2021 The Complete Guide

Average Salary In Sweden 2021 The Complete Guide

Swedish Employee Benefits And Perks Glassdoor

Swedish Employee Benefits And Perks Glassdoor

Understanding Payroll In Sweden What Global Companies Need To Know About Sweden Payroll

Understanding Payroll In Sweden What Global Companies Need To Know About Sweden Payroll

5 Reasons To Work In Sweden Sweden Se

5 Reasons To Work In Sweden Sweden Se

Https Wageindicator Org Documents Decentworkcheck Europe Sweden English Pdf

Swedish Match Compensation And Benefits

Swedish Match Compensation And Benefits

Health Care Professionals Jobs Careers Swedish Hospital

Health Care Professionals Jobs Careers Swedish Hospital

Employment Relations In Germany And Sweden

Employment Relations In Germany And Sweden

The Swedish Work Ethic The Swedish Working Culture Has Gained By Sarah Tottle Medium

5 Reasons To Work In Sweden Sweden Se

5 Reasons To Work In Sweden Sweden Se

What You Need To Know About Payroll In Sweden

What You Need To Know About Payroll In Sweden

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.